illinois electric car tax credit 2020

An electric vehicle means an electric vehicle. Compare the costs of driving on electricity with eGallon.

Is Rivian Stock A Buy As It Appoints New Coo To Jumpstart Production Investor S Business Daily

Unless its an electric motorcycle which doesnt qualify.

. This new provision part of Senate Bill 58 that was supported by both the Chicago Automobile Trade Association CATA and Illinois Automotive Dealers Association reverses the 10000 cap that was set in 2020. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the vehicle into Illinois. Definition 625 ILCS 512-805. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. For more on registering your vehicle with the IL Vehicle Services Department refer to our car registration section. State has decided to join a parade of other states offering their own state tax credit for EV purchases.

To determine how much you owe consult the SOS Vehicle License Plate Guide. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an. Also out are hybrids and cars that run on fuel cells natural gas carrot peels etc.

3rd 2019 805 pm PT. Pay less at the plug. Federal electric vehicle EV tax credits for a few of the countrys largest auto manufacturers one US.

Ad Answer Simple Questions About Your Life And We Do The Rest. June 23 2021 Uncategorized 0 Comment. Illinois is set to finally offer residents an EV rebate following a sweeping new bill subsidizing nuclear power plants and.

Local and Utility Incentives. Illinois electric vehicle tax credit 2020. Understanding electric vehicle tax credits for 2021 is a little complex but absolutely worth your time if youre serious about going electric.

Illinois vehicle registration fees for electric cars is 251 per registration year. JB Pritzker signed Illinois clean energy law on Wednesday which includes a 4000 rebate for residents to buy an electric vehicle EV. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

You should attach a copy of the bill of sale as proof of the purchase price. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Incentives to drive electric include reducing the cost of your car electric fuel or maintenance.

With no government incentives or tax credits the manufacturers suggested retail price for a new plug-in electric vehicle was just over 50000 in. Thanks to a new law effective Jan. Illinois electric vehicle tax credit 2020.

Beginning on January 1 2020 the registration fee for Electric vehicles shall be equal to the fee set forth in Section 3-806 for motor vehicles of the first division other than Autocycles Motorcycles Motor Driven Cycles and. TurboTax Makes It Easy To Get Your Taxes Done Right. Beginning on January 1 2021.

Payments are due on the 7th 15th 22nd and the last day of the month. File With Confidence Today. Electric Vehicles Solar and Energy Storage.

Illinois ranked seventh in EV sales last year at 6400 vehicles and with a total of about 15000 electric vehicles registered in the state. Understanding your federal PEV tax credit eligibility. Illinois ridiculous 1000 EV tax is no more imposes 100 EV tax instead UPDATED Jameson Dow.

Following the release of updated US. January 3 2022 0900 AM. This article previously stated the EV tax would be 248.

Jun 23 2021 by. Coleman received a 7500 federal tax credit on his 40000 Chevy Bolt last year. The cost of fueling an EV is less than half that of a conventional vehicle.

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. Affirmation for Electric Vehicle. Here I break down the federal tax credit and provide a comprehensive list of state EV rebates and utility company incentives.

The federal government offers an income tax credit of up to 7500 on all-electric and plug-in hybrid cars that arewere purchased new in or after 2010. Taxpayers who mail their quarter-monthly payments to the department must complete Form RPU-50 Public Utilities Quarter-Monthly Payment - Electricity Excise Tax. But charging owners more to drive an electric vehicle in Illinois might slow down the momentum for EVs in the state.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. At least 50 of the qualified vehicles miles must be driven in the state and the credit expires at. To pay for rebates officials are relying on the Alternate Fuels Fund a 20 annual fee levied on vehicles owned by businesses with a fleet of 10 or more.

Do not send Form RPU-50 if you remit your payment electronically. The credit amount will vary based on the capacity of the battery used to power the vehicle. Payments can be made using MyTax Illinois.

JB Pritzker said his. The amount of credit one is eligible for varies based on the capacity of the battery thats used to power the vehicle. No Tax Knowledge Needed.

1 2022 retail vehicle buyers now receive the full tax credit on trade-ins. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. Most new EVs are eligible for up to a 7500 federal tax credit.

Electric Vs Gas Is It Cheaper To Drive An Ev Nrdc

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Rebates And Tax Credits For Electric Vehicle Charging Stations

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Green New Deal Or Stale Old Tax Break Scam Getting Electric Vehicle Incentives Right Non Profit News Nonprofit Quarterly

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

What Is Illinois Car Sales Tax

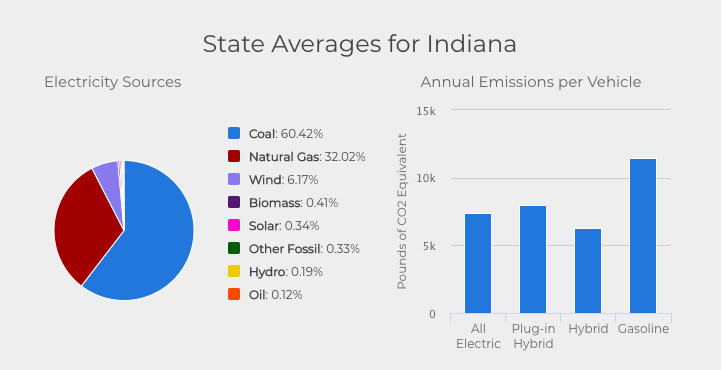

Electric Vehicles Have Lower Well To Wheel Emissions In All 50 States And Dc Than Gas Powered Vehicles Evadoption

Electric Vehicles Should Be A Win For American Workers Center For American Progress

The 14 Best American Made Evs To Watch For 2022 Leafscore

How Many Evs Are Registered In Your State You May Be Surprised

Tesla Posts Sales Of Almost 1 Million Cars In 2021 News Dw 03 01 2022

Top States For Electric Vehicles Quotewizard

How Many Evs Are Registered In Your State You May Be Surprised

Reimagining Electric Vehicles Rev Illinois Program Rev

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek